If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

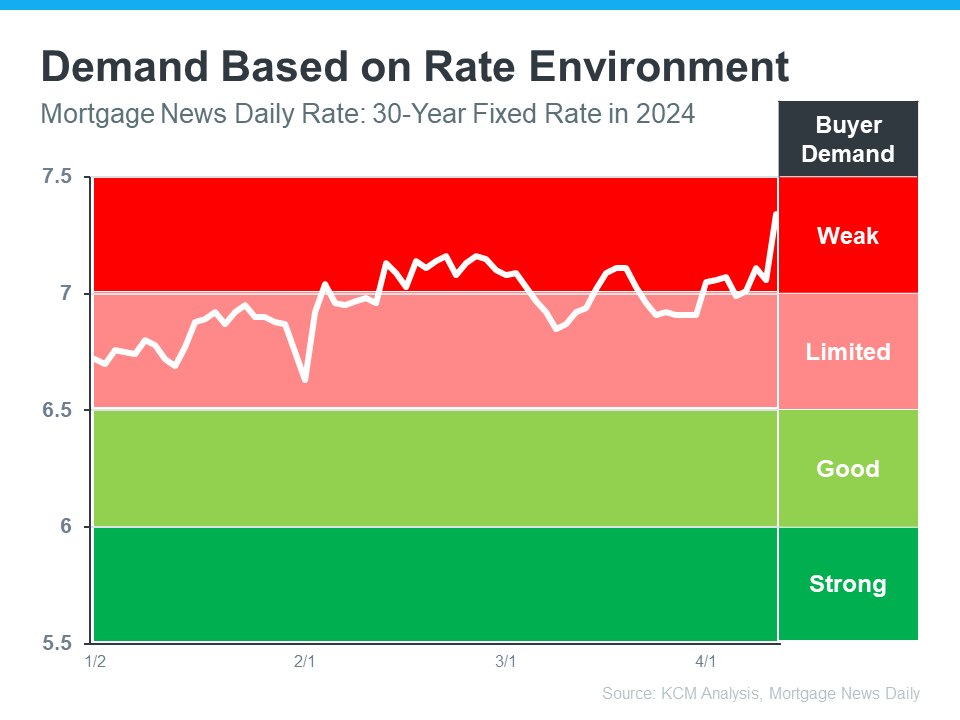

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, talk to a real estate agent.

]]>![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240424/Equity-Can-Make-Your-Move-Possible-When-Affordability-Is-Tight-KCM-Share.png)

Some Highlights

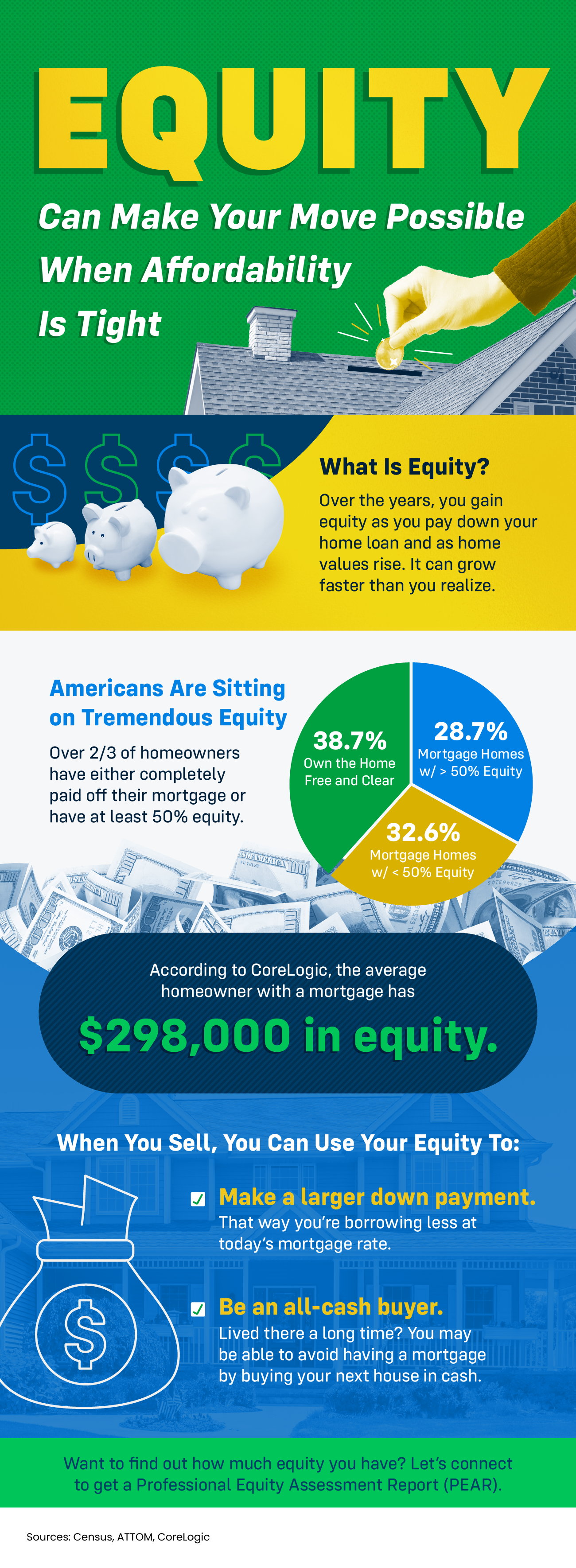

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

![Equity Can Make Your Move Possible When Affordability Is Tight [INFOGRAPHIC] Simplifying The Market](https://files.keepingcurrentmatters.com/KeepingCurrentMatters/content/images/20240424/Equity-Can-Make-Your-Move-Possible-When-Affordability-Is-Tight-KCM-Share.png)

Some Highlights

- Did you know the equity you have in your current house can help make your move possible?

- Once you sell, you can use it for a larger down payment on your next home, so you’re borrowing less. Or, you may even have enough to be an all-cash buyer.

- The typical homeowner has $298,000 in equity. If you want to find out how much you have, connect with a local real estate agent for a Professional Equity Assessment Report.

If you’ve got a move on your mind, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

In the housing market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, talk to a real estate agent.

]]>

When mortgage rates spiked up over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy for you?

In today’s market, data shows more homeowners are getting used to where rates are and thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

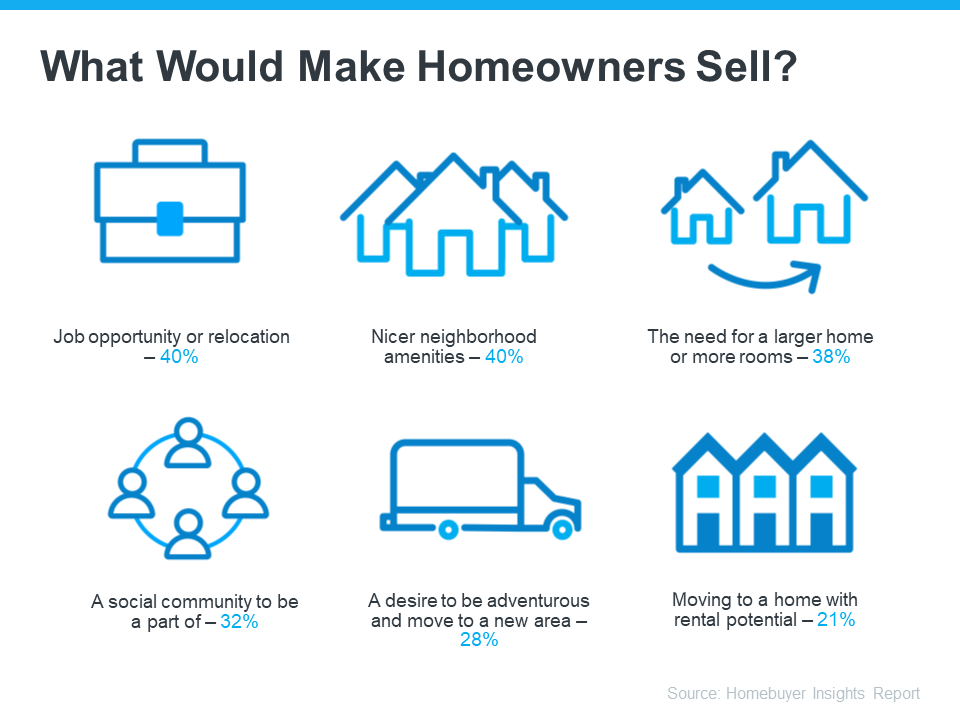

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below):

What Would Motivate You To Move?

Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income.

And here’s something else to consider. Mortgage rates are still expected to go down over the course of the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends.

You’ll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps. An expert can help with that.

Bottom Line

Other homeowners are getting used to rates and deciding to move. Talk to a local real estate agent to go over what matters most to you and if it’s time for you to jump back into the market too.

]]>

If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you. They may even be why you’ve put your plans on hold for now. When rates climbed near 8% last year, some buyers found the numbers just didn’t make sense for their budget anymore. That may be the case for you too.

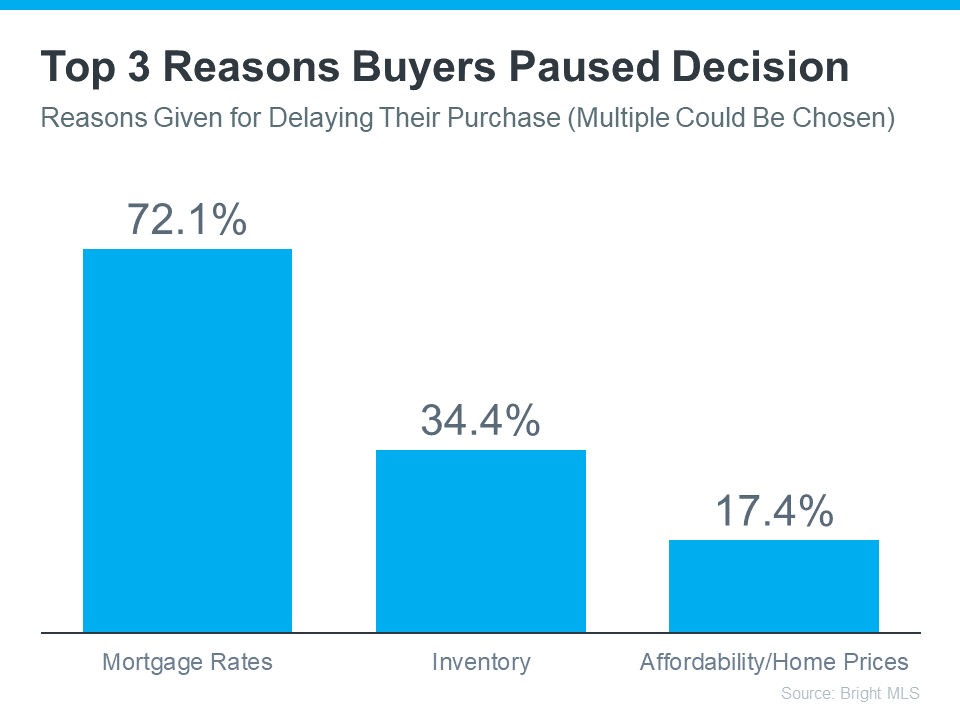

Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below):

David Childers, CEO at Keeping Current Matters, speaks to this statistic in the recent How’s The Market podcast:

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

That’s because mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility in rates, the longer-term projections show rates should continue to drop this year, as long as inflation gets under control. Experts even say we could see rates below 6% by the end of 2024. And that threshold would be a gamechanger for a lot of buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead. If your plans were delayed, there’s light at the end of the tunnel again. That means it may be time to start thinking about your move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

The exact percentage where you feel comfortable kicking off your search again is personal. Maybe it’s 6.5%. Maybe it’s 6.25%. Or maybe it’s once they drop below 6%.

Once you have that number in mind, here’s what you do. Connect with a local real estate professional. They’ll help you stay informed on what’s happening. And when rates hit your target, they’ll be the first to let you know.

Bottom Line

If you’ve put your plans to move on hold because of where mortgage rates are, think about the number you want to see rates hit that would make you ready to re-enter the market.

Once you have that number in mind, connect with a real estate professional so you have someone on your side to let you know when we get there.

]]>

Life is a journey filled with unexpected twists and turns, like the excitement of welcoming a new addition, retiring and starting a new adventure, or the bittersweet feeling of an empty nest. If something like this is changing in your own life, you may be considering buying or selling a house. That’s because through all these life-altering events, there is one common thread—the need to move.

Reasons People Still Need To Move Today

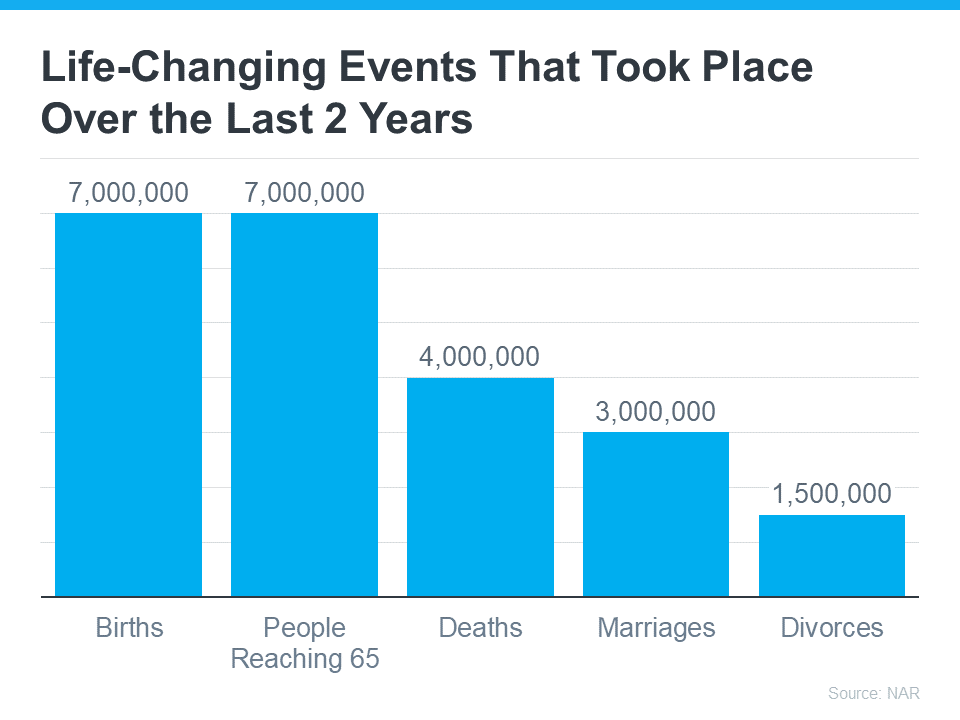

According to the National Association of Realtors (NAR) there have been a lot of this type of milestone or life change over the last two years (see graph below):

And, these big life changes are going to continue to impact people moving forward, even with the current affordability challenges brought on by higher mortgage rates and rising home prices.

As Claire Trapasso, Executive News Editor at Realtor.com, says:

“Because high mortgage rates, elevated home prices, and stubbornly low inventory make today’s housing market particularly challenging, many of today’s buyers are motivated by life changes, such as growing families, supporting elderly parents or grown children, or accommodating professional needs. . .”

Lean On a Real Estate Professional for Help

Whether you’re beginning your search for a home or preparing to sell your current house, you don’t have to go it alone. With their expertise, a real estate agent is an invaluable partner who can help you smoothly transition through these big moments in your life. Here are just a few examples.

When Buying a Home

If you’re welcoming a new addition and want more space, the need for a new home may be a top priority. While higher home prices and mortgage rates are creating challenges for buyers, you may have to find a way to meet your changing needs, even with today’s mortgage rates.

A skilled real estate agent can help. Their expertise and knowledge of the local housing market can save you a considerable amount of time and stress. An agent will take the time to understand your specific needs, budget, and preferences, allowing them to narrow down your search and present you with suitable options.

When Selling a House

If you’re retiring or going through a separation or divorce, your main focus may be to make the most out of your investment when selling your house, so you can find one that works better for you moving forward.

This is another place where a real estate agent’s expertise truly shines. They can accurately assess your home’s market value, suggest improvements to enhance its appeal, and craft a strategic marketing plan. Their negotiation skills are a big asset when it comes to making sure you get a fair price for your house, allowing you to move on to the next chapter of your life with confidence and peace of mind.

No matter your situation, lean on a trusted professional for help as you buy or sell a home.

Bottom Line

If recent life-changing events have you wanting or needing to move, connect with a local real estate agent.

]]>

If you’re considering selling your house right now, it’s likely because something in your life has changed. And while things like mortgage rates play a big role in your decision, you don’t want that to overshadow why you thought about making a move in the first place.

It’s true mortgage rates are higher right now, and that has an impact on affordability. As a result, some homeowners are deciding they’ll wait to sell because they don’t want to move and have a higher mortgage rate on their next home.

But your lifestyle and your changing needs matter, too. As a recent article from Realtor.com says:

“No matter what interest rates and home prices do next, sometimes homeowners just have to move—due to a new job, new baby, divorce, death, or some other major life change.”

Here are a few of the most common reasons people choose to sell today. You may find any one of these resonates with you and may be reason enough to move, even today.

Relocation

Some of the things that can motivate a move to a new area include changing jobs, a desire to be closer to friends and loved ones, wanting to live in your ideal location, or just looking for a change in scenery.

For example, if you just landed your dream job in another state, you may be thinking about selling your current home and moving for work.

Upgrading

Many homeowners decide to sell to move into a larger home. This is especially common when there’s a need for more room to entertain, a home office or gym, or additional bedrooms to accommodate a growing number of loved ones.

For example, if you’re living in a condo and your household is growing, it may be time to find a home that better fits those needs.

Downsizing

Homeowners may also decide to sell because someone’s moved out of the home recently and there’s now more space than needed. It could also be that they’ve recently retired or are ready for a change.

For example, you’ve just kicked off your retirement and you want to move somewhere warmer with less house to maintain. A different home may be better suited for your new lifestyle.

Change in Relationship Status

Divorce, separation, or marriage are other common reasons individuals sell.

For example, if you’ve recently separated, it may be difficult to still live under one roof. Selling and getting a place of your own may be a better option.

Health Concerns

If a homeowner faces mobility challenges or health issues that require specific living arrangements or modifications, they might sell their house to find one that works better for them.

For example, you may be looking to sell your house and use the proceeds to help pay for a unit in an assisted-living facility.

With higher mortgage rates and rising prices, there are some affordability challenges right now – but your needs and your lifestyle matter too. As a recent article from Bankrate says:

“Deciding whether it’s the right time to sell your home is a very personal choice. There are numerous important questions to consider, both financial and lifestyle-based, before putting your home on the market. . . . Your future plans and goals should be a significant part of the equation . . .”

Bottom Line

If you want to sell your house and find a new one that better fits your needs, get in touch with a real estate expert. They’ll be there to guide you through the process and help you find a home that works for you.

]]>

Reaching retirement is a significant milestone in life, bringing with it a lot of change and new opportunities. As the door to this exciting chapter opens, one thing you may be considering is selling your house and finding a home better suited for your evolving needs.

Fortunately, you may be in a better position to make a move than you realize. Here are a few reasons why.

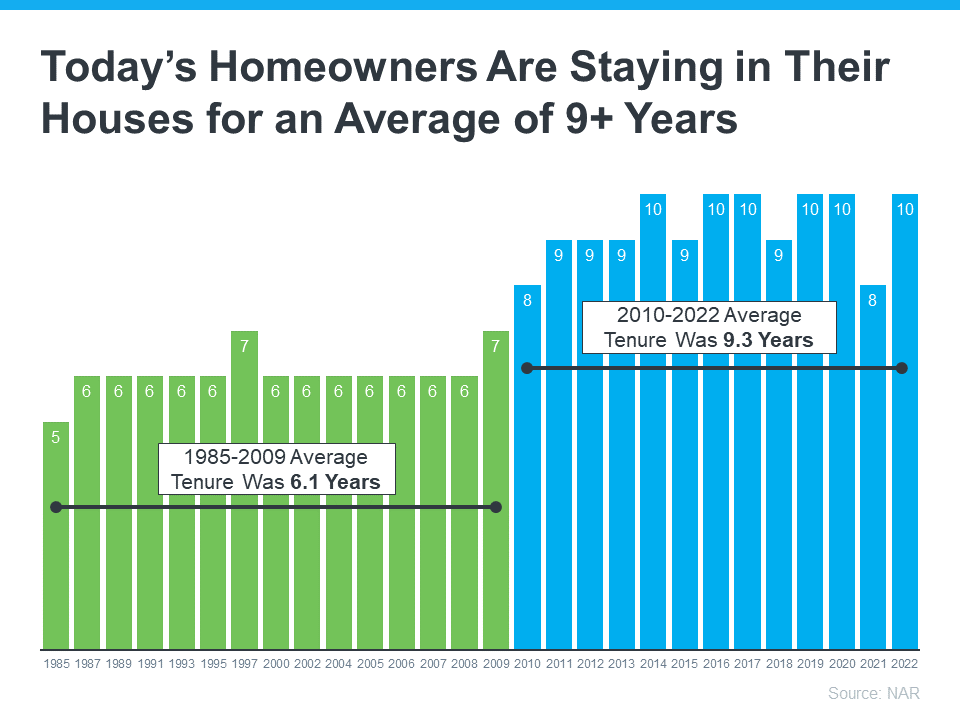

Consider How Long You’ve Been in Your Home

From 1985 to 2009, the average length of time homeowners stayed in their homes was roughly six years. But according to the National Association of Realtors (NAR), that number is higher today. Since 2010, the average home tenure is just over nine years (see graph below):

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

This means many homeowners have been living in their houses even longer in recent years. When you live in a home for such a significant amount of time, it’s natural for you to experience changes in your life while you’re in that house. As those life changes and milestones happen, your needs may change. And if your current home no longer meets them, you may have better options waiting for you.

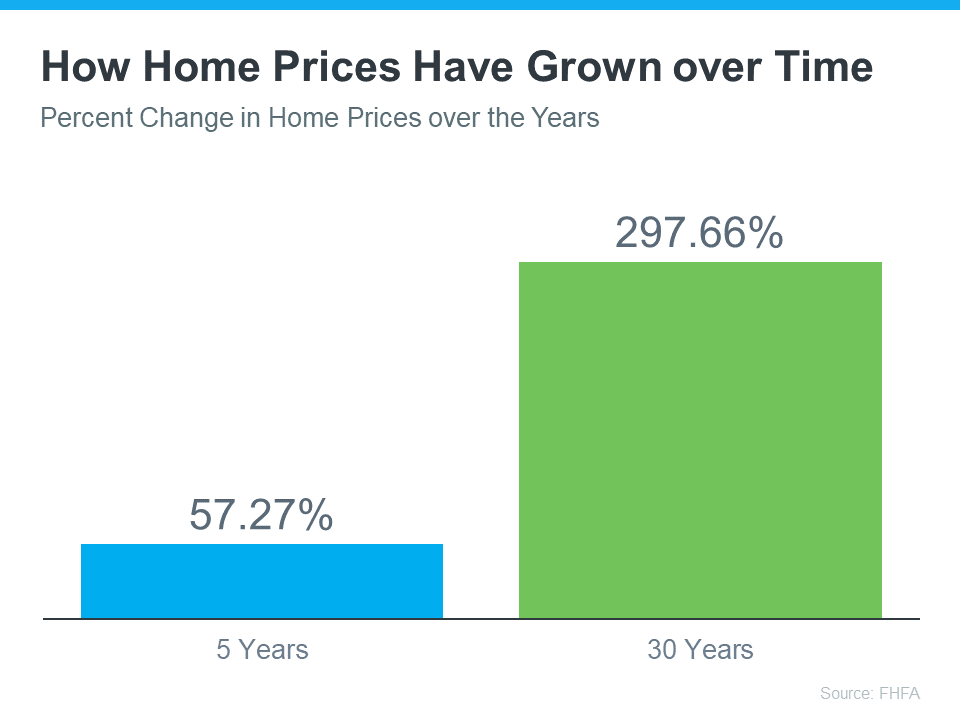

Consider the Equity You’ve Gained

And, if you’ve been in your home for more than a few years, you’ve likely built-up substantial equity that can fuel your next move. That’s because you gain equity as you pay down your loan and as home prices appreciate. And, the longer you’ve been in your home, the more you may have gained. Data from the Federal Housing Finance Agency (FHFA) illustrates that point (see graph below):

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

While home prices vary by area, the national average shows the typical homeowner who’s been in their house for five years saw it increase in value by nearly 60%. And the average homeowner who’s owned their home for 30 years saw it almost triple in value over that time.

Whether you’re looking to downsize, relocate to a dream destination, or move so you live closer to friends or loved ones, that equity can help. Whatever your home goals are, a trusted real estate agent can work with you to find the best option. They’ll help you sell your current house and guide you as you buy the home that’s right for you and your lifestyle today.

Bottom Line

As you plan for your retirement, connect with a local real estate agent to find out how much equity you’ve built up over the years and plan how you can use it toward the purchase of a home that fits your changing needs.

]]>

If you’re a homeowner ready to make a move, you may be thinking about using your current house as a short-term rental property instead of selling it. A short-term rental (STR) is typically offered as an alternative to a hotel, and they’re an investment that’s gained popularity in recent years.

While a short-term rental can be a tempting idea, you may find the reality of being responsible for one difficult to take on. Here are some of the challenges you could face if you rent out your house instead of selling it.

A Short-Term Rental Comes with Responsibilities

Successfully managing your house as a short-term rental takes a lot of time and effort. You’ll have to juggle tasks like dealing with reservations, organizing check-ins, and tackling cleaning, landscape, and maintenance duties. Any one of those can feel demanding, but all together it’s a lot to handle.

Short-term rentals experience high turnover rates, as new guests check in and out frequently. This home traffic can lead to increased wear and tear on your property—meaning you may need to make more frequent repairs or replace your furniture, fixtures, and appliances more often.

Think through your ability to make that level of commitment, especially if you plan to use a platform that advertises your rental listing. Most of them have specific requirements hosts must meet. An article from Bankrate explains:

“Managing a rental property can be time-consuming and challenging. Are you handy and able to make some repairs yourself? If not, do you have a network of affordable contractors you can reach out to in a pinch? Consider whether you want to take on the added responsibility of being a landlord, which means screening tenants and fielding issues, among other responsibilities, or paying for a third party to take care of things instead.”

There’s a lot to consider before taking the leap and converting your house into a short-term rental. If you aren’t ready for the work it takes, it could be wise to sell instead.

Short-Term Rental Regulations

As the short-term rental industry continues to grow, regulations have increased. Legal restrictions commonly include limits on the number of vacation rentals in a particular location. This is especially true in larger cities and tourist destinations where there may be concerns about overcrowding or housing shortages for permanent residents. Restrictions may also apply to the type of property that can be used for short-term rentals.

Many cities also require homeowners to obtain a license or permit before renting out their properties. Nick Del Pego, CEO at Deckard Technologies, explains:

“Renting short-term rentals is considered a business by most local governments, and owners must comply with specific workplace regulations and business licensing rules established in their local communities.”

It is important to thoroughly check whether short-term rentals are regulated or prohibited by the local government and your homeowners association (HOA) before even considering renting out your home.

Bottom Line

Converting your home into a short-term rental isn’t a decision you should make without doing your research. To decide if selling your house is a better alternative, talk with a local real estate agent today.

]]>